AI for Brokers in the Insurance Industry: What Brokers Need to Know

The insurance industry is undergoing a massive transformation powered by Artificial Intelligence (AI). Once viewed as a future trend, AI is now a present-day tool reshaping how insurance brokers work, communicate, and compete.

From automating repetitive admin tasks to offering hyper-personalised client advice, AI is streamlining workflows and unlocking smarter decision-making.

In this blog article, we’ll explore how insurance brokers – especially those in Australia – can harness AI tools to save time, reduce errors, and grow their books of business.

Why AI Matters for Insurance Brokers

Today’s insurance clients expect fast, accurate service and tailored advice. Brokers are under pressure to deliver greater value, stay compliant, and operate more efficiently – all while managing rising expectations around digital service.

AI offers the tools to:

- Automate quoting, policy comparisons, and documentation

- Speed up claims handling and client communication

- Surface cross-sell and upsell opportunities

- Improve compliance and audit-readiness

- Help brokers stand out in a competitive market

For brokers, AI isn’t replacing the human element – it’s enhancing it.

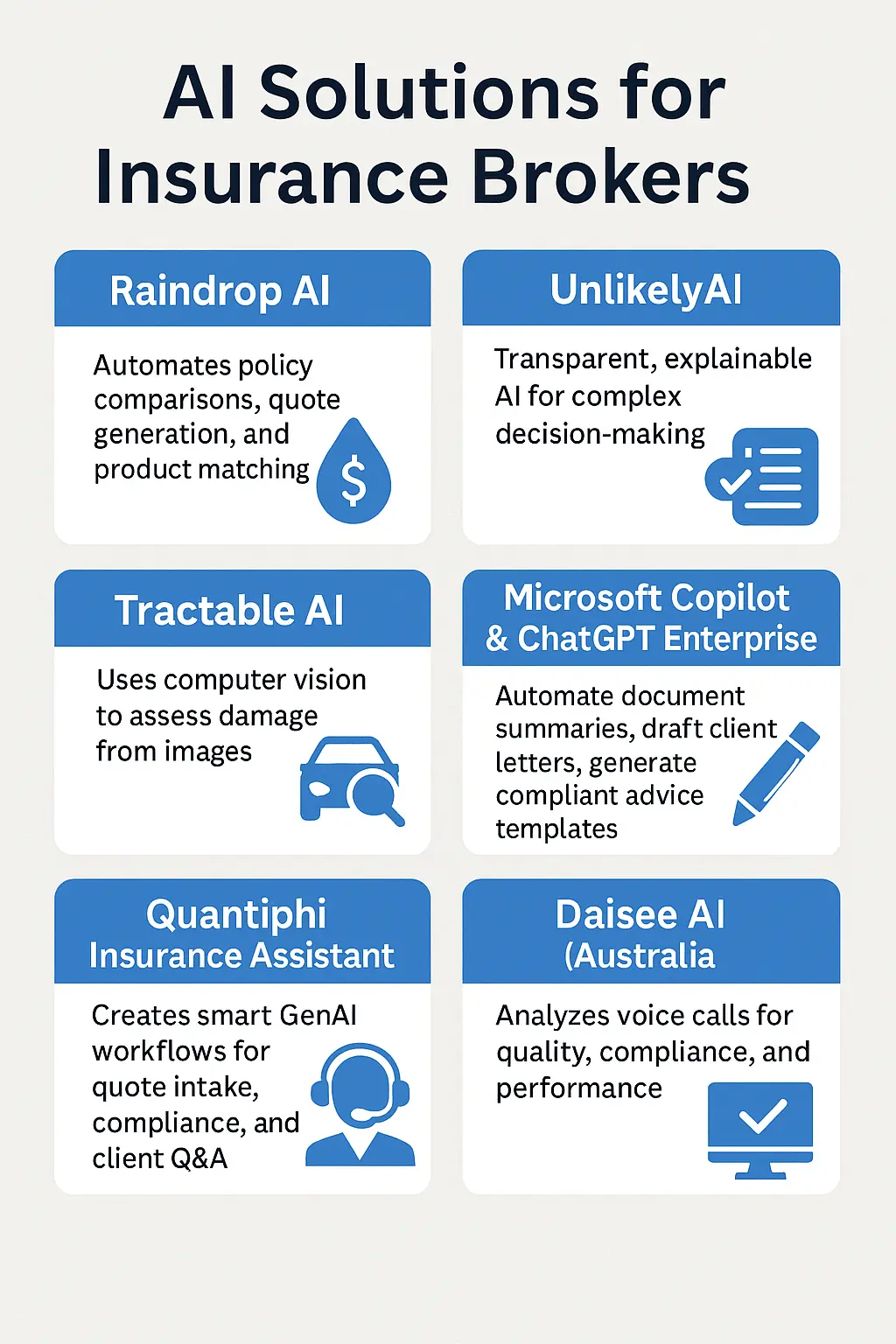

AI Tools Built for Brokers

Here are some of the most practical AI solutions currently used by insurance brokers in Australia and globally:

Raindrop AI (Australia)

- What it does: Automates policy comparisons, quote generation, and product matching.

- How brokers benefit: Saves hours on research, improves accuracy, and makes compliance easier when presenting options.

UnlikelyAI

- What it does: Transparent, explainable AI for complex decision-making.

- Broker use: Helps justify advice and claims decisions, providing a clear trail for auditors or regulators.

Tractable AI

- What it does: Uses computer vision to assess damage from images (e.g., vehicles, property).

- Use case: Streamlines motor and property claims—especially valuable in the FNOL (first notice of loss) process.

Microsoft Copilot & ChatGPT Enterprise

- What they do: Automate document summaries, draft client letters, generate compliant advice templates.

- Broker use: Accelerates document creation and reduces time spent on email or form-based communication.

Quantiphi Insurance Assistant

- What it does: Creates smart GenAI workflows for quote intake, compliance, and client Q&A.

- Broker use: Brokers or aggregator networks can deploy digital assistants to prequalify clients or handle repetitive queries.

Daisee AI (Australia)

- What it does: Analyses voice calls for quality, compliance, and performance.

- Broker use: Ideal for firms running call centres or supervising multiple agents. Flags issues and highlights improvement opportunities.

Zelros AI

- What it does: AI product recommendation engine using life event data and policy trends.

- Broker use: Embedded in CRMs, it guides cross-selling or coverage optimisation conversations.

Voice Bots for Insurance Brokers & Industry

Voice-based AI is rapidly gaining popularity as brokers seek ways to manage high call volumes, reduce wait times, and serve clients outside business hours.

Here are some voice AI platforms worth exploring:

- PolyAI – Natural-sounding AI phone agents that converse like a human.

- Kore.ai – Full-service virtual assistants that cover quoting, claims, and customer service.

- Nuance (Microsoft) – Secure biometric authentication and call automation.

- Cogito AI (Verint) – Real-time coaching for brokers during live calls.

- Skit.ai – High-volume voice bots ideal for outbound reminders or post-sale follow-ups.

- Cognigy.AI – Omnichannel bots integrated with call centres (used by Zurich and others).

These tools let brokers scale their service without increasing headcount—ideal for growth-focused businesses.

Global and Enterprise-Level AI Tools Being Used in Insurance

While the broker-facing tools above are very practical, it’s also useful to know what enterprise-level systems insurers and underwriters are using.

Here are some examples of AI programs and tools that are shaping the broader ecosystem brokers work in:

| Category | Examples |

|---|---|

| Policy comparison | Raindrop (AU) |

| Document & data automation | Microsoft Copilot, EXL Insurance LLM, watsonx (IBM) |

| Underwriting & risk scoring | Quantexa, SAS Viya, LexisNexis |

| Claims automation | Tractable, Feedzai, LexisNexis |

| AI agents & orchestration | UnlikelyAI, Hexaware Tensai® |

| Customer engagement | Zurich ZCAM CRM, Anthropic Claude |

| Consulting & implementation | KPMG, EY GenAI, McKinsey, Deloitte AI |

Understanding these broader systems enables brokers to align more effectively with carrier capabilities and stay ahead of the digital transformation curve.

Practical AI Use Cases for Brokers

Let’s look at how brokers are already using AI to boost productivity:

- Quote Generation: Tools like Raindrop streamline comparisons across insurers with automation and audit-ready compliance notes.

- Claims Lodgement: With Tractable or voice bots, brokers can lodge claims quickly using photos or client audio input.

- Client Onboarding: AI chatbots or assistants handle FAQs, collect pre-quote data, and even recommend products.

- Document Prep: Tools like ChatGPT Enterprise draft Statements of Advice (SoAs), cover letters, and renewal emails with speed and consistency.

- Sales Coaching: Call monitoring platforms like Daisee give managers insight into what’s being said on calls—useful for training and regulatory compliance.

Staying Compliant with AI in Australia

Australian brokers must remain mindful of regulatory guidance from:

- ASIC – on advice obligations and digital conduct

- APRA – especially for firms managing risk or client funds

- OAIC – regarding privacy and data use in AI systems

Best practices include:

- Using explainable AI tools (like UnlikelyAI or IBM’s Watsonx)

- Maintaining audit trails of decisions and advice

- Ensuring transparency in client-facing recommendations

Benefits of AI for Insurance Brokers

AI is not a threat to brokers – it’s an enabler.

By using the right tools, brokers can spend less time on admin and more time on what matters: advising clients, building relationships, and growing their businesses. Whether you’re an independent adviser, a mid-size brokerage, or part of a larger group, adopting AI early will give you a competitive edge.

Now is the time to explore the AI tools that work best for your workflow, team, and clients.

Further Resources from David Staughton

Find out more about AI Tools with these AI Learning Resources – just get started with ChatGPT or Microsoft CoPilot.